Health Insurance Use-Cases: Designing Incentive Programs

When designing incentive programs for policyholders using Sahha, health insurers should consider many factors that create a great experience for individuals and their unique health requirements.

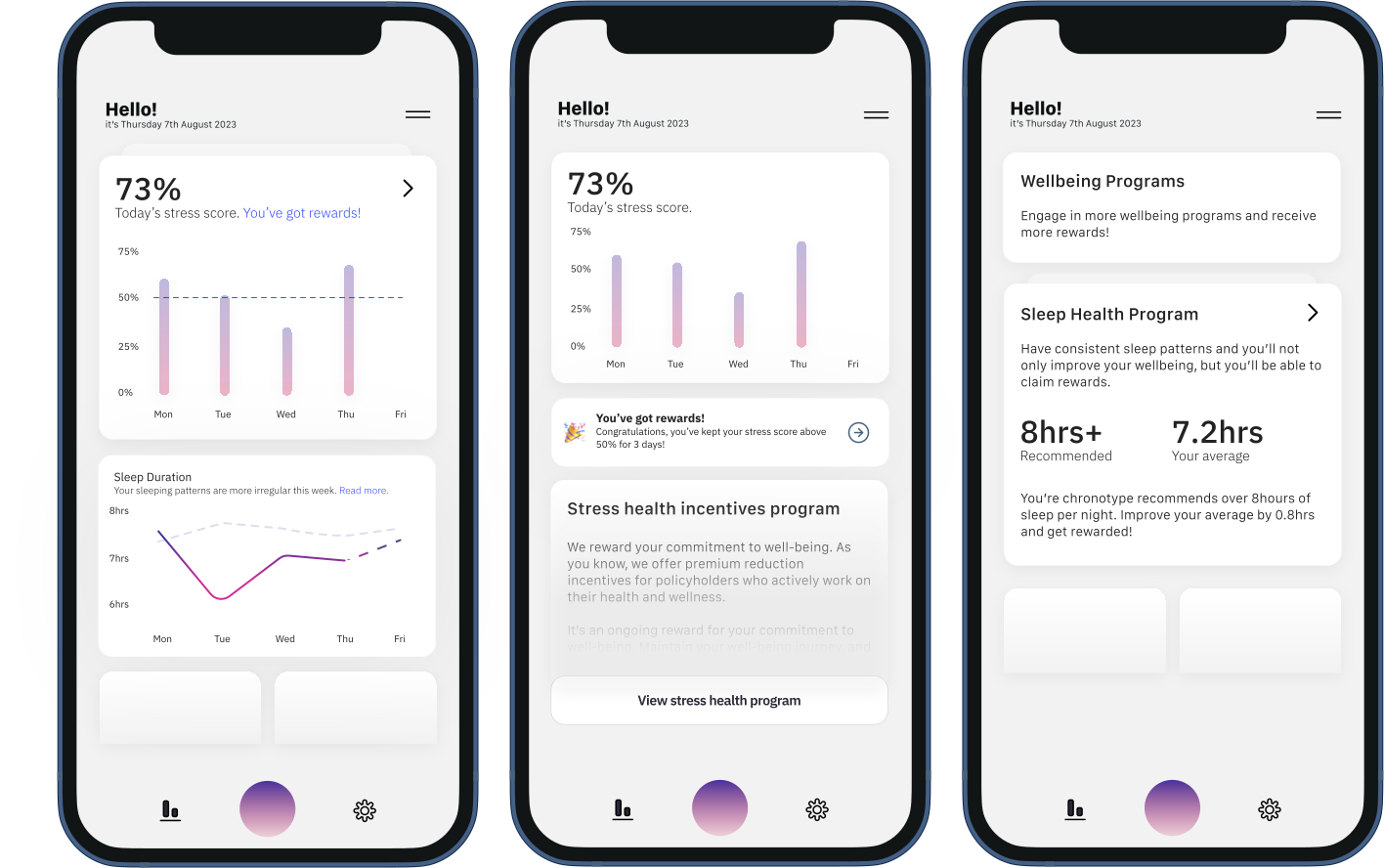

A short guide to designing engaging programs delivered through apps

Alignment with Well-Being Goals is crucial to both policy-holder and insurer success. Ensure incentives align with the insurer's well-being and health promotion objectives and that they are delivered to policy-holders in a way that incentivises engagement.

example:

Core components of great well-being programs

Well-designed wellbeing programs often feature 3 components for insurers and their customers:

- Policyholder Wellness App: A health insurer can create a policyholder wellness app where users set their well-being goals, such as achieving a specific well-being score, reducing stress levels, or increasing physical activity. Incentives, such as premium reductions or wellness rewards, are tied to the achievement of these goals.

- Personalized Health Challenges: Insurers can design personalized health challenges within their mobile app, encouraging policyholders to align their well-being objectives with insurer-defined goals. For instance, users may be challenged to maintain a certain well-being score for an extended period, ensuring that their health aligns with the insurer's wellness standards.

- Condition-Specific Programs: Insurers can offer condition-specific well-being programs for policyholders with chronic conditions like diabetes or hypertension. These programs can be designed to align with the management and improvement of these conditions, providing tailored incentives for adherence to care plans and lifestyle changes.

Core concepts of incentivising well-being

Aspects to think about when designing & delivering well-being programs that are engaging and respective to users

- Personalization:

- Leverage Sahha's data to offer personalized incentives based on policyholders' well-being metrics and goals.

- Transparency and Communication:

- Clearly communicate program details, expectations, and the value of incentives to policyholders.

- Variety of Incentives:

- Offer a range of incentives, including premium reductions, gift cards, wellness products, and more.

- Well-Being Tracking and Feedback:

- Use Sahha data to track policyholders' well-being progress and provide actionable feedback.

- Goal-Oriented Rewards:

- Tie incentives to well-being improvement goals and reward goal achievement.

- Engagement and Gamification:

- Gamify the program with challenges, leaderboards, and achievements for added engagement.

- Long-Term Sustainability:

- Encourage long-term well-being improvements and offer ongoing rewards for commitment.

- Data Privacy and Security:

- Emphasize data security and privacy, and communicate how data is used and protected.

- Feedback and Iteration:

- Collect feedback from policyholders and iterate on the program for improvements.

- Well-Being Education:

- Provide educational resources to guide policyholders on making informed well-being choices.

- Legal and Compliance:

- Ensure the program complies with relevant insurance and well-being program regulations.

By considering these factors, health insurers can design effective incentive programs that motivate policyholders to prioritize their well-being and make healthier lifestyle choices, benefiting both the insurer and the insured.